We actually need to stay in your house. My legal professional outlined that I need to Test into a Reverse Mortgage loan. Is this something which could support us?

Who's this for? Longtime homeowners with lots of equity will like that Rocket Home loan helps you to dollars out the total worth of your private home, as compared to 80% to ninety% with most lenders.

Nevertheless, you’ll need to pay back non-public home finance loan insurance policies (PMI) if you put down under twenty% of the acquisition price. A different prospective downside is always that common home loans usually have better interest fees than federal government-backed loans for instance FHA or VA loans.

Common home loans demand a three% deposit. They permit you to finance a house really worth as much as an once-a-year optimum proven by Fannie Mae, a federally-based home finance loan enterprise.

Your spouse just isn't eligible for any reverse mortgage loan nonetheless, she could possibly be an eligible non-borrowing partner. She wouldn't be about the loan but would have the many protections of a borrower and will continue to be in the home for life without having to repay the loan beneath the exact same conditions while you given that she also paid out the property fees on time and lived in the house as her Major residence.

To start with, you’ll have to submit own and monetary data to each lender, and several will supply to deliver you mortgage loan quotes soon after examining your finances. Most institutions now offer fully on-line apps, and you can also 55 loan Evaluate loan presents from multiple lenders on web-sites like LendingTree and Credible.

Proprietary reverse mortgages provide further benefits, especially for Those people with distinct housing conditions, such as condominium entrepreneurs. These private systems have their own list of approval requirements, which often can differ from HUD’s suggestions.

Lifetime insurance policy guideLife insurance coverage ratesLife insurance policy policies and coverageLife insurance coverage quotesLife coverage reviewsBest lifetime insurance policies companiesLife insurance policies calculator

The listings highlighted on This website are businesses from which we generate affiliate connection payment. Placement and Show can be motivated by these kinds of compensation. Advertising Disclosure Fund.com

HDFC Bank offers many repayment options for maximizing house loan eligibility to suit numerous demands.

Seniors have mortgage choices just like anybody else: Thanks to the Equal Credit history Option Act, It is really from the legislation to discriminate in opposition to an applicants on account of their age.

For those who've created up a lot of equity over the years, you might be a good candidate for property finance loan refinancing or a house equity loan or HELOC. If you're looking to downsize or commence about someplace new in retirement, on the other hand, You will also find acquire home loans for seniors.

Interest rate: This can be the quantity the lender expenses you to borrow, expressed as a proportion of the amount borrowed. Rates you’re offered may count on your credit history score, money, loan quantity and loan term, between other variables, and likely will vary by lender.

The HUD HECM application is This system that might be the best option for you personally but It isn't accessible to you right until you switch 62 years outdated. The personal or proprietary packages will go all the way down to decreased values in some instances but the lowest we see is usually $450,000.

Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Shane West Then & Now!

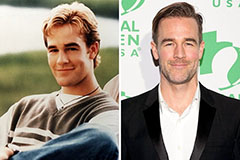

Shane West Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now!